VanEck an Investment Powerhouse Anticipates US Election to Propel Bitcoin BTC to Unprecedented Heights

VanEck, a leading asset management company, predicts that the upcoming US election will have a positive impact on Bitcoin (BTC), resulting in new record highs. According to the head of digital asset research at VanEck, the recent decline in Bitcoin and other digital assets is due to the government selling off its holdings into relatively small markets around the 4th of July.

The German government has been actively selling off a significant amount of its confiscated Bitcoin in recent weeks. VanEck acknowledges that BTC rarely trades below its 200-day moving average during bull market years. However, if government selling persists and negative news continues to emerge, Bitcoin’s price could dip below the current $36,000 mark.

Despite these challenges, VanEck highlights several positive factors that could boost BTC’s performance. These include the expectation of a smooth landing for the US economy, a potential reversal in monetary policy, and the likelihood of a Trump presidency after the November election.

VanEck suggests that the election could lead to new all-time highs for Bitcoin, as the market factors in four more years of deficit spending and a potentially more favorable regulatory environment under a Trump administration. Additionally, emerging and frontier markets, such as Kenya, Ethiopia, and Argentina, have announced their adoption of Bitcoin mining using government-owned energy.

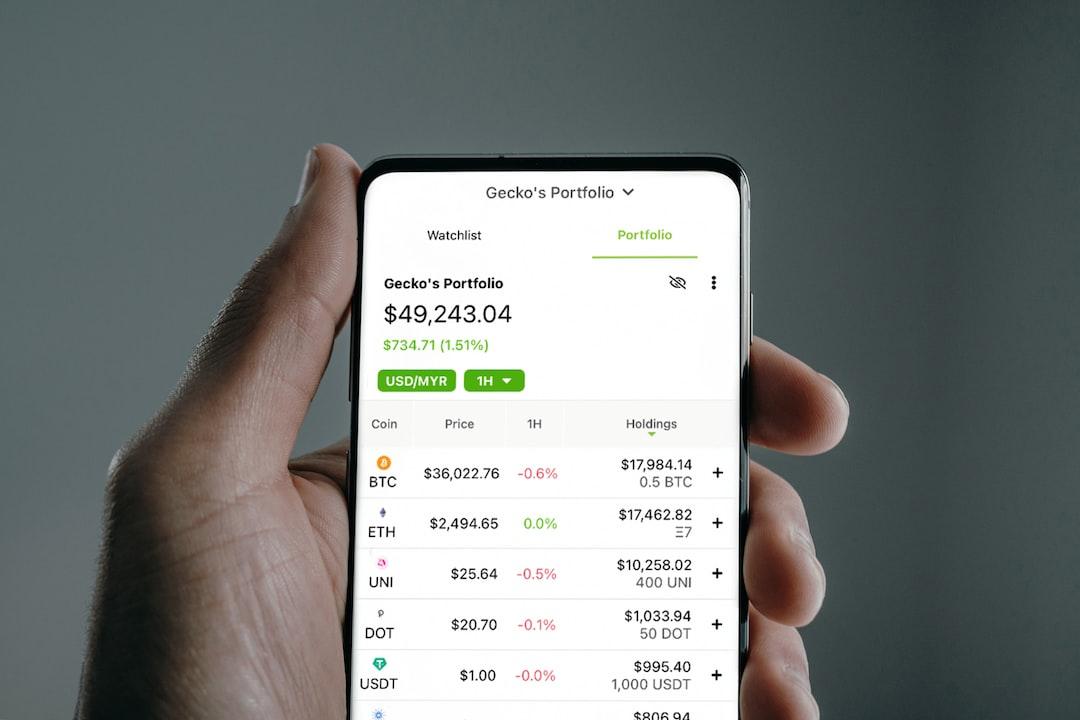

To capitalize on the potential growth of Bitcoin, VanEck recommends a dollar cost average strategy for investors, advising them to gradually increase their BTC and ETH holdings up to a target weight of 6% in most benchmarked portfolios.

As of the time of writing, Bitcoin is trading at $55,898.

Disclaimer: The opinions expressed in this article are not investment advice. Investors should conduct their own research before engaging in high-risk investments in Bitcoin, cryptocurrency, or digital assets. Please be aware that any transfers or trades you make are at your own risk, and any losses incurred are your responsibility. The Daily Hodl does not endorse the buying or selling of cryptocurrencies or digital assets, and it is not a financial advisor. Please note that The Daily Hodl may participate in affiliate marketing.